If the Government Shutsdown Government Worker Will Continue to Get Paid

- Finance

- Watchlists

- My Portfolio

- Cryptocurrencies

- Yahoo Finance Plus

- All Markets Summit

- Screeners

- Markets

- Options: Highest Open Interest

- Options: Highest Implied Volatility

-

- News

- Personal Finance

- Videos

- Influencers with Andy Serwer

- America: Back in Business

-

- Yahoo U

- Industries

- Tech

- Contact Us

-

S&P Futures

-

Dow Futures

-

Nasdaq Futures

-

Russell 2000 Futures

-

Crude Oil

-

Gold

-

Silver

-

EUR/USD

-

10-Yr Bond

-

Vix

-

GBP/USD

-

USD/JPY

-

BTC-USD

-

CMC Crypto 200

-

FTSE 100

-

Nikkei 225

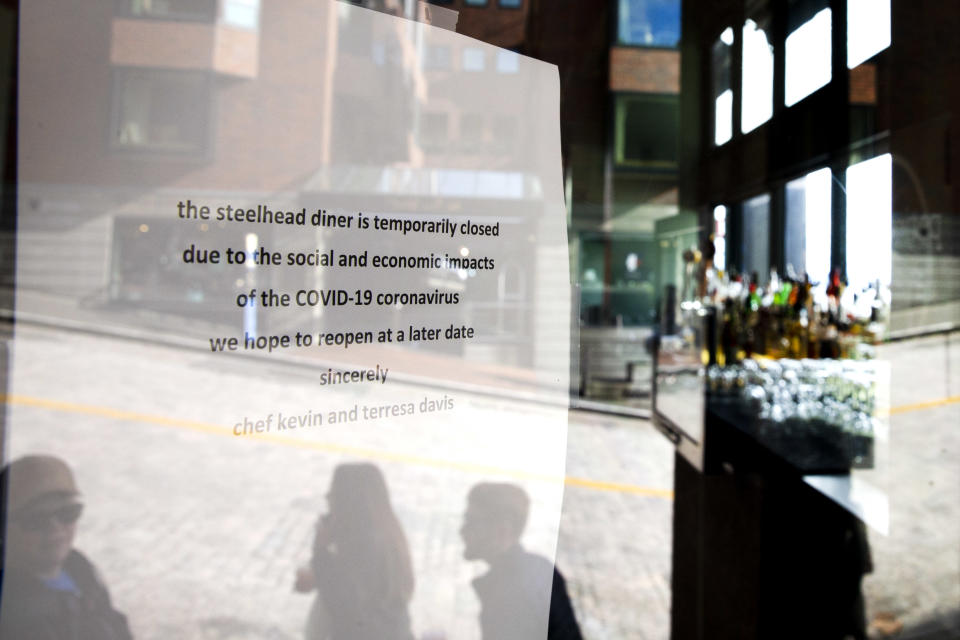

The US government clarifies when workers must get paid amid coronavirus shutdowns

The U.S. Department of Labor (DOL) posted new guidance this week clarifying compensation requirements for employees who have worked only partial work weeks due to coronavirus-related business closures.

Salaried workers exempt from being paid overtime, if mandated by their employers to stay home, must be paid in full even if they complete only a partial week's work. Non-exempt workers are not similarly protected. Under the Fair Labor Standards Act (FLSA), employers need only pay non-exempt employees for hours worked, regardless of whether they had been scheduled to work additional time.

"The general rule is that you don't have to pay [exempt workers] for a week in which they perform no work, but if they work a portion of the week then you owe an exempt employee their full salary," Zach Hutton, an employment lawyer with the Paul Hastings law firm, told Yahoo Finance.

Hutton said he's been fielding questions from employer clients uncertain of their responsibilities to compensate employees when the quantity of an employee's work is compromised as a result of working outside the usual place of business. Until the DOL issued its new guidance it was unclear whether a viral outbreak would justify reducing employee compensation.

"The new guidance reinforces that if an employer has a shutdown and instructs employees to stay at home and not work, an exempt employee doesn't have to be paid for a week in which they perform no work, but they generally do have to be paid for a week in which they perform some work," he said.

Do employers have to pay for work-at-home expenses?

Additional unforeseen expenses that may arise for employers are tied to local rules that can require reimbursement of employee expenses incurred during a work-from-home mandate. In certain states the scenario triggers non-negotiable costs for employers.

In California, for example, employers must reimburse reasonable and necessary employee business expenses, Hutton said. "So if [employers] suggest, or strongly suggest, or require that an employee telecommute," he said, "then you can unwittingly end up with an obligation to pay for a portion of the employees' expenses."

Expenses could include home office equipment, supplies and internet connectivity, just to name a few.

"In the aggregate, that cost can be substantial," Hutton said.

Though expense reimbursement may be somewhat offset by savings realized due to less trafficked offices, the extent of savings will largely depend on the size and scope of an employer's workforce. Employers that save on maintenance, cleaning services and utilities can't avoid major fixed costs such as rent, mortgage and insurance premiums.

Ira Klein, also a Paul Hastings attorney, said a decision to instruct employees to work from home during the outbreak should be based on an assessment of an employee's exposure risk. Exposure risk, he said, can be difficult to assess because they allow for interpretation. Risk levels — low, medium and high — are based on the likelihood of transmission at work, where employees may either contract COVID-19 or spread it to others.

"There's so many different ways to look at risk," Klein said, explaining that guidance comes from separate agencies and laws that must be read together, including the Centers for Disease Control and Prevention (CDC), the Occupational Safety and Health Administration (OSHA), and state and local authorities.

Under OSHA, he said, healthcare workers who engage in close person-to-person contact are considered high risk. Other layers of risk analysis under OSHA are based on whether the work is performed in an area of widespread transmission, and whether a worker's job places her in contact with people returning from areas of widespread transmission. Whether a job places a worker in contact with the general public is also considered. CDC guidance differs, Klein said, in that it is more focused on individual employee actions such as travel and sanitary practices.

As COVID-19 spreads, challenges for employers to make the right call are becoming increasingly difficult.

"Guidance from agencies, including the CDC and OSHA, and state level agencies and local health departments, are being updated in nearly real time," Klein said. "If an employer is doing everything that's reasonable, given agency guidance from the CDC and OSHA, and an employee still says, 'I don't want to come to work,' I think that those are where the hard questions will come up."

Alexis Keenan is a reporter for Yahoo Finance. Follow her on Twitter @alexiskweed.

Read more:

Americans need to start canceling travel to slow down the coronavirus

'Never seen anything like this': Bookings for overseas flights from US plummet

Coronavirus has spurred an 'unprecedented' wave of US flight cancellatons, analyst says

Airline CEOs warn coronavirus is cutting into reservations and are prepared for it to get worse

Coronavirus and travel: What you need to know

Follow Yahoo Finance on Twitter , Facebook , Instagram , Flipboard , LinkedIn , YouTube , and Reddit .

Source: https://finance.yahoo.com/news/the-us-government-clarifies-when-workers-must-get-paid-amid-coronavirus-shutdowns-200803771.html

0 Response to "If the Government Shutsdown Government Worker Will Continue to Get Paid"

Post a Comment